Artificial intelligence (AI) is transforming industries left and right, and accounting is no exception. Whether you’re a CPA, bookkeeper, or business owner, AI-powered tools can help automate tedious tasks, improve accuracy, and free up time for higher-level financial strategy.

But does that mean AI is coming for accountants’ jobs? Not quite.

How AI is Changing Accounting for the Better

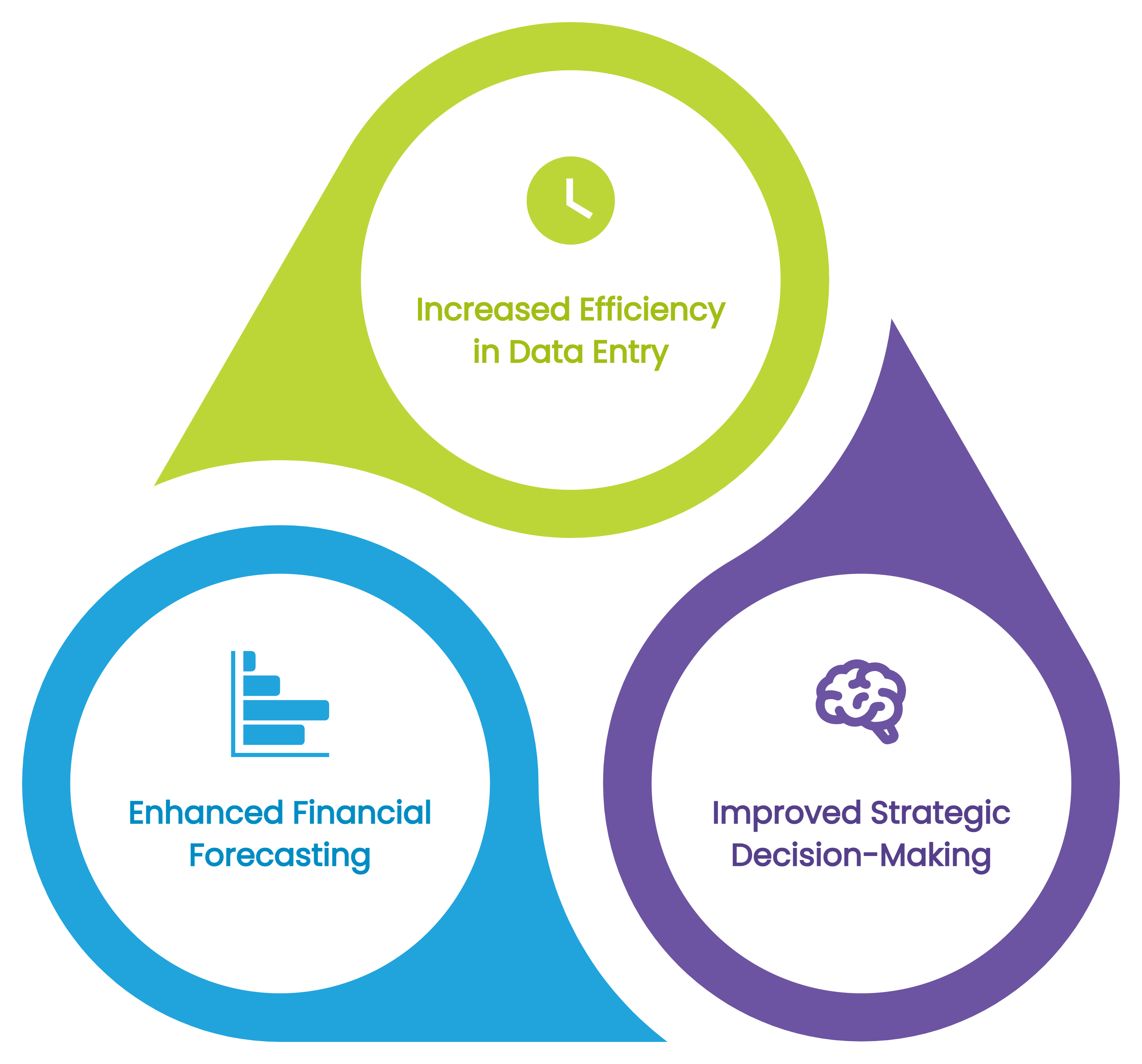

At its core, AI helps accountants work faster and smarter. It handles repetitive tasks that eat up time like data entry, invoice processing, and financial forecasting so professionals can focus on strategic decision-making.

And this trend is only growing.

- 71% of accountants believe AI will bring major changes to the industry.

- AI in accounting is expected to grow 30% per year through 2027.

- 80% of CFOs plan to increase AI spending within the next two years.

The reason is simple: AI helps firms stay competitive. By automating workflows and reducing human error, AI makes accounting more efficient and profitable.

AI in Action: Where Accountants Are Using It Today

Accounting firms are already leveraging AI for:

- Financial forecasting – AI predicts cash flow trends and financial risks.

- Automating workflows – AI handles invoices, reconciliations, and approvals.

- Expense management – AI categorizes transactions and flags discrepancies.

- Client communication – AI helps draft emails, summarize conversations, and automate responses.

- Data analysis – AI identifies patterns in financial reports for better decision-making.

Rather than replacing accountants, AI enhances their work turning them into problem solvers instead of number crunchers.

Will AI Replace Accountants?

Short answer: No.

AI is powerful, but it lacks human judgment, ethics, and the ability to build relationships. Accounting isn’t just about crunching numbers it’s about advising clients, interpreting data, and ensuring compliance with complex regulations.

Here’s why accountants aren’t going anywhere:

- AI doesn’t have business intuition. Financial decisions require experience, critical thinking, and industry knowledge that AI can’t replicate.

- Clients value human relationships. Trust, communication, and personalized advice are core to the profession.

- AI needs oversight. AI can analyze data, but humans must review and interpret its findings to ensure accuracy.

That’s why 71% of accountants believe a firm’s value actually drops if it doesn’t use AI. The key isn’t resisting AI it’s learning how to use it effectively.

AI Trends Shaping Accounting in 2025

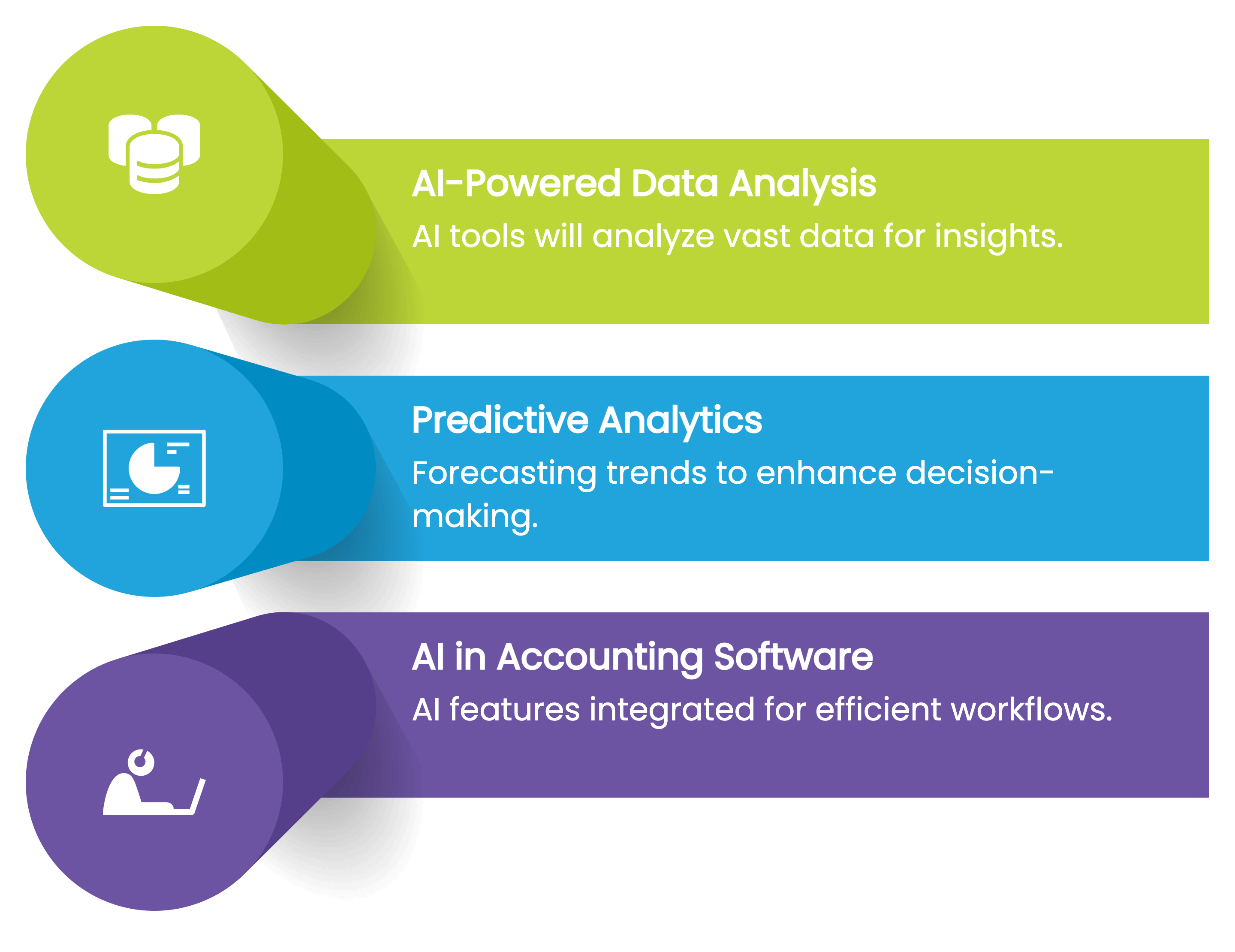

1. AI-Powered Data Analysis

Gone are the days of manually sifting through spreadsheets. AI now processes massive amounts of financial data in seconds, providing real-time insights and identifying risks faster than ever.

Jason Staats, founder of Realize, uses ChatGPT to organize financial data from unstructured text, saving hours of manual work. His take? “It’s as simple as copy-pasting transactions, and AI turns it into structured information instantly.”

What this means for accountants: AI won’t take your job it’ll take the boring parts of it.

2. Predictive Analytics for Smarter Decision-Making

AI doesn’t just analyze past data it predicts future trends. From forecasting revenue to identifying fraud risks, AI helps businesses make data-driven financial decisions.

Rather than spending hours generating reports, accountants now evaluate AI’s predictions and fine-tune them based on experience and context.

3. AI Embedded in Accounting Software

AI is most useful when it works where you already do. That’s why firms are integrating AI directly into their accounting platforms.

Automated email drafting

AI-generated financial reports

Smart categorization of transactions

One-click invoice processing

Instead of switching between apps, AI-powered accounting software streamlines everything into one seamless workflow.

Best AI Tools for Accountants: Features, Pros & Cons, and Use Cases

With so many AI-powered tools emerging, how do you know which ones are actually useful for your accounting firm? Below, we break down some of the most powerful AI solutions, highlighting their key features, real-world applications, and pros and cons to help you make the right choice.

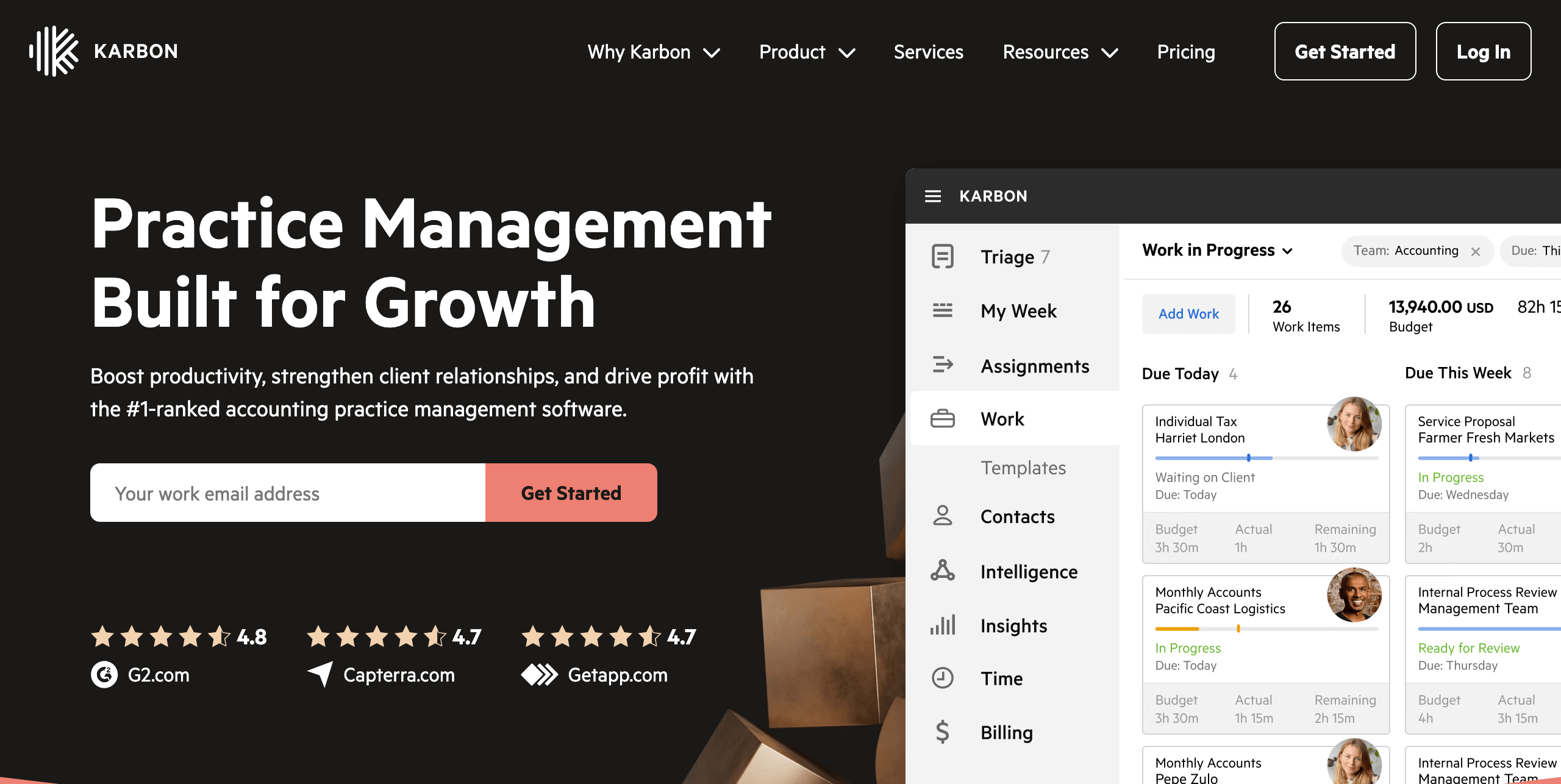

1. Karbon AI – AI-Powered Email & Workflow Automation

What It Does:

Karbon AI is an AI-driven assistant built into Karbon’s practice management software. It helps accountants automate workflows, manage client communication, and streamline task management.

Key Features:

- AI-generated email summaries – Quickly get up to speed on long email threads.

- Smart email drafting – Automatically generates client responses.

- Task automation – AI suggests tasks and deadlines based on work history.

- Client communication tracking – Keeps conversations organized and contextualized.

Pros:

- Fully integrates with Karbon’s workflow tools

- Saves time by summarizing long emails and discussions

- Helps ensure no client communication slips through the cracks

Cons:

- Primarily focused on email and task management (not full accounting automation)

- Still evolving – some features are in early stages

Best For:

Accounting firms looking to automate email workflows, reduce administrative overhead, and improve client response times.

2. Vic.ai – AI for Invoice Processing & Compliance

What It Does:

Vic.ai automates invoice processing and accounts payable workflows, eliminating manual data entry and reducing human errors.

Key Features:

- Automated invoice extraction – AI reads and categorizes invoice data.

- Autonomous approval workflows – Suggests or automates invoice approvals.

- Fraud detection & compliance checks – Flags suspicious transactions.

- Predictive insights – Helps forecast cash flow and payment trends.

Pros:

- Saves hours of manual invoice processing

- Improves accuracy and compliance by reducing human errors

- Scales well for firms handling high invoice volumes

Cons:

- Expensive initial setup costs can be high (up to $25,000)

- Not ideal for small firms with low invoice volume

Best For:

Mid-to-large-sized accounting firms and finance teams managing high volumes of invoices and expenses.

3. Botkeeper – AI-Powered Bookkeeping Assistant

What It Does:

Botkeeper combines AI with human oversight to automate bookkeeping tasks, helping firms manage accounts, reconciliations, and financial reports.

Key Features:

- Automated transaction categorization – AI sorts expenses and income.

- Reconciliations & financial reports – Handles monthly close-outs.

- Customizable dashboards – Provides real-time financial insights.

- AI + human review – Ensures data accuracy.

Pros:

- Reduces manual bookkeeping work

- Provides real-time financial insights

- Scalable for firms of all sizes

Cons:

- No free trial

- Initial setup can be complex for firms with unique workflows

Best For:

Firms that want to automate bookkeeping without losing human oversight.

4. Receipt-AI – AI for Receipt & Expense Management

What It Does:

Receipt-AI streamlines receipt tracking by automatically extracting data from uploaded receipts and integrating with accounting software.

Key Features:

- AI-powered receipt scanning – Extracts key information automatically.

- Email & SMS uploads – Send receipts via text or email for instant processing.

- Direct QuickBooks & Xero integration – Auto-syncs expense data.

- Auto-categorization – Suggests correct expense categories.

Pros:

- Saves time on manual data entry

- Reduces risk of lost receipts

- Works with mobile devices for on-the-go processing

Cons:

- Currently only supports SMS uploads in the U.S. and Canada

- Limited user reviews still a newer tool

Best For:

Businesses and accounting firms looking for an easy, AI-powered way to manage receipts and expenses.

5. Rows AI – AI-Powered Spreadsheet Automation

What It Does:

Rows AI is a modern spreadsheet editor that integrates AI to analyze, summarize, and transform financial data.

Key Features:

- AI-powered data analysis – Identifies trends and insights.

- Automated data structuring – Cleans and organizes messy data.

- Data enrichment – Fills in missing financial details.

- Text classification & summarization – Helps process large datasets.

Pros:

- Intuitive interface with AI-driven automation

- Free plan available

- Works well for financial modeling and data analysis

Cons:

- Not specifically designed for accounting workflows

- Some users report missing features compared to Excel

Best For:

Accountants and financial analysts who frequently work with spreadsheets and need an AI-powered data assistant.

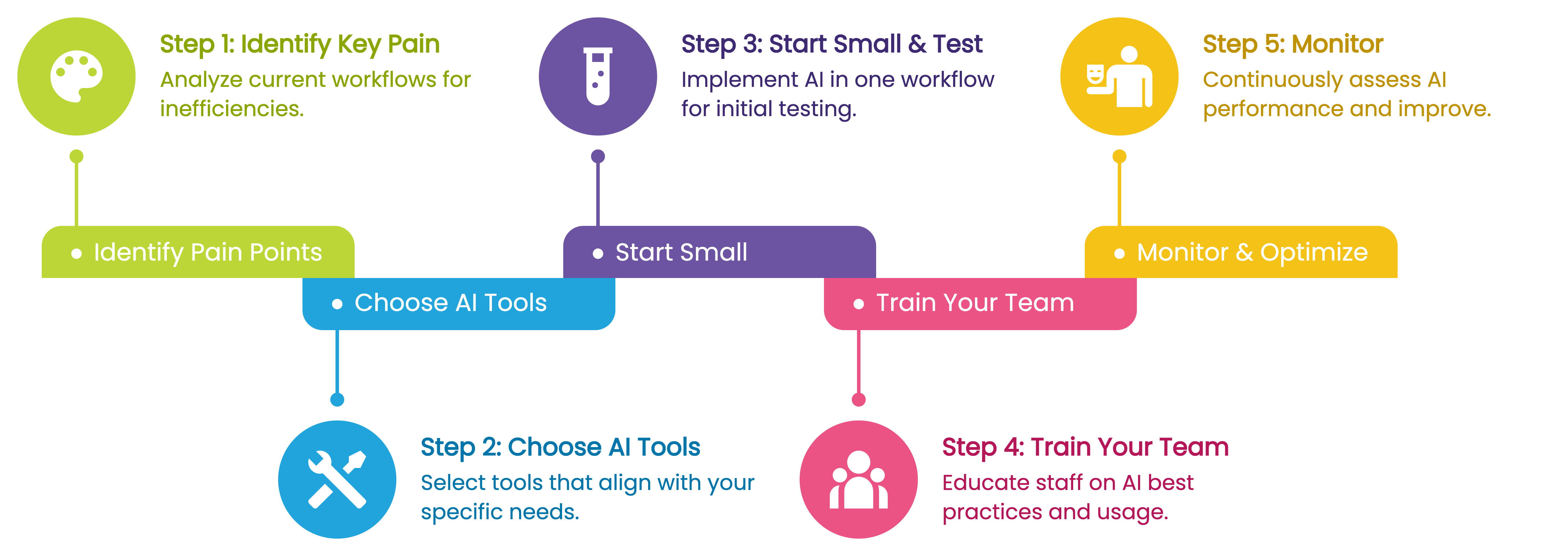

How to Successfully Implement AI in Your Accounting Workflow

Adopting AI in your firm isn’t just about choosing the right tools you also need a solid strategy for integrating AI into your existing processes. Here’s a step-by-step guide to help your team make the transition smoothly.

Step 1: Identify Key Pain Points

Before introducing AI, analyze your current workflows to pinpoint the most time-consuming or error-prone tasks. Common areas where AI can help include:

- Manual data entry and reconciliation

- Invoice and expense processing

- Report generation and financial forecasting

- Email communication and client inquiries

Step 2: Choose AI Tools That Fit Your Needs

Not every AI tool will be a good fit for your firm. Use the breakdown above to evaluate which solutions align with your firm’s size, workflow, and budget.

Step 3: Start Small & Test AI in One Workflow

Instead of overhauling your entire process overnight, start by testing AI in one area. For example:

- Implement Receipt-AI to automate expense tracking.

- Use Karbon AI to streamline email communication.

- Try Vic.ai for invoice automation.

Monitor how AI impacts efficiency before rolling it out firm-wide.

Step 4: Train Your Team on AI Best Practices

AI is only as good as the people using it. Provide hands-on training to ensure employees know:

- How to interpret AI-generated insights

- When to verify AI’s outputs

- How to troubleshoot AI-related issues

Encourage a learning mindset so your team embraces AI as a tool, not a threat.

Step 5: Monitor Performance & Optimize

Once AI is up and running, track key metrics like:

- Time saved on manual tasks

- Reduction in errors

- Improved client response times

If AI isn’t delivering the expected results, refine your workflows, tweak AI settings, or explore alternative tools.

AI isn’t here to replace accountants it’s here to make them more efficient, strategic, and valuable. By adopting AI tools that automate repetitive tasks and enhance decision-making, firms can improve productivity, reduce errors, and focus on delivering high-value services to clients.

The key is to start small, choose the right tools, and continuously refine your AI strategy.

AI in Accounting

AI is here to stay, and it’s making accounting faster, smarter, and more efficient. But it’s not a replacement for accountants it’s a tool that enhances their expertise.

Firms that embrace AI will have a competitive edge, improving efficiency, reducing errors, and focusing on high-value financial strategy.

The key? Learning to work with AI, not against it.